What You Need to Know About Can I Repair My Car After Filing a Claim?

You ought to report the accident if you would like your car repaired and can't afford it without an insurance policy payment. If you're involved in a crash, and you have liability insurance, all is not losing. You have to be responsible, or the collision should have been your fault. If you're involved with a car crash, and your vehicle is severely damaged, your insurance provider might declare it an entire loss, in which case, they'll either pay you or change out your car. If you are concerned about a vehicle crash, your assets are definitely in danger. Just because you've got an automobile accident doesn't mean you will lose assets to other folks who were involved. It is crucial to remember that the damage caused by a car accident may exceed the coverage of a liability policy.

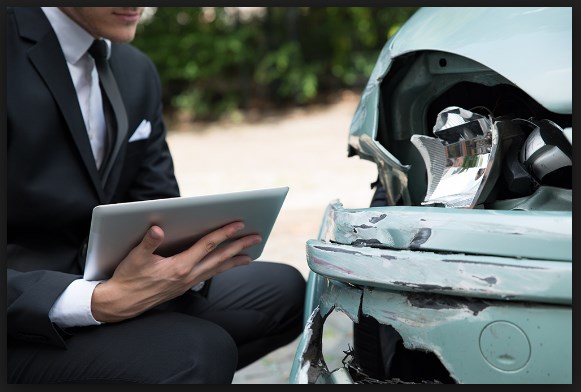

If you opt to repair your car yourself, it's an incredibly excellent concept to have an adjuster consider the damage and give an estimate before you do any of the jobs. If your auto damaged in an accident and you have liability coverage, you are going to have to pay out-of-pocket for auto repairs. If a similar car isn't available locally, the firm might look further, but bear in mind; areas also dictate the worth of cars. An expensive or almost-new auto, however, may be well worth the effort.

After the car is prepared to get back on the street, there ought to be some last paperwork, especially if you're at fault. If your auto hit in the same spot, the insurance company might not pay out back merely due to the fact you didn't have it repaired the very first time. To determine whether or not it is totaled, the insurance company calculates the cost it would take to improve the car. In the occasion the automobile is stolen, the authorities will care for the removal of the truck. As a consequence, if you discover an abandoned car on your premises, call the police first.

You should allow the repair facility know how frequently you'd love to get updated so that they can satisfy your expectations. Even though the repair facility might want to cover the estimate with you and explain the repair and claims process, that could be accomplished by phone. What you have to do is ensure you have selected a high-quality repair facility to do the job on your car or truck and just let that shop manage the insurance carrier.

Can I Repair My Car After Filing a Claim? - Dead or Alive?

In case you have Collision Coverage or Comprehensive Coverage on your own Auto Policy (based on the basis for damage), your insurance provider will cover the cost to your vehicle no matter who might have been responsible for the crash or incident (assuming you have not intentionally led to the destruction yourself). If you don't have liability insurance, you must renegotiate the conditions of your loan or provide an extra kind of collateral to the lending company. Collision insurance is the kind of coverage which is used to cover repairs which you might have caused to your motor vehicle. If you're utilizing the protection for your very own personal car to cover the rental and it has comprehensive or glass, then it's likely that your insurance will pay for the expense to replace the windshield. Detailed automobile insurance can found from Farm Bureau Insurance.

Insurance businesses may issue an extension for some cases, including a home that can't evaluate for some time after a significant storm or catastrophe. As a final resort, you are also able to sue the insurance provider. Insurance companies typically consider the wholesale value of a vehicle. They, according to the Homeowners Insurance Guide, set their time limits for filing a claim. In fact, they can't make you cross to only 1 location for repairs, but they'll ask which you get extra than one estimate to make sure that they do not pay an inflated restore bill. You also need to get in touch with your insurance provider despite the fact that you were not to blame. Your insurance policy provider will probably insist on it.

If it doesn't, you will be responsible for contacting the insurance carrier and filing the claim. If the insurance provider resists, owners may need to take them to court. If you're, that could reduce the total paid to you by the insurance carrier. Now imagine what it's like to manage the insurance company of somebody you don't understand who crashed into your vehicle.

Posting Komentar